The 5-Second Trick For Offshore Banking

3%, some offshore banks can get upwards of 3-4%, though this could not adequate reason alone to financial institution within the jurisdiction, it does inform you that not all banking systems were developed equal. 4. International Banks Have a Safer Banking System, It is vital to see to it your assets are saved in a Placing your wide range in a secure, as well as a lot more importantly, tried and true financial system is very crucial.

The large business financial institutions really did not also come close. Foreign banks are much safer choice, for one, they call for higher capital books than lots of financial institutions in the US and UK. While several financial institutions in the UK and US need approximately just 5% gets, numerous worldwide financial institutions have a much higher capital get ratio such as Belize and Cayman Islands which carry average 20% and 25% respectively.

The quickest way to avoid this from happening is to establish up a worldwide checking account in an abroad jurisdiction account that is outside the reach of the government. 6 - offshore banking. Utilizing a Financial System that is Safe as well as Has Audio Economic Policies in your house nation. Some offshore banks, for instance, do not lead out any type of cash as well as keep 100% of all deposits available.

Examine This Report about Offshore Banking

While several domestic accounts limit your capability in holding various other currency denominations, accounts in Hong Kong or Singapore, for instance, allow you to have upwards of a loads currencies to picked from all in just one account. 8. Foreign Accounts Provides You Greater Asset Defense, It pays to have well-protected finances.

With no accessibility to your assets, just how can you defend on your own in court? Money and properties that are kept offshore are much harder to take due to the fact that international federal governments do not have any jurisdiction and also for that reason can not compel financial institutions to do anything. Regional courts and federal governments that regulate them only have actually restricted impact (offshore banking).

It's not if - it's when. In the US, there more than 40 million brand-new lawsuits filed annually, with 80% of the world's legal representatives living in the USA, that is not also unexpected. If you are hit with a claim you can be virtually reduced off from all your assets before being brought to test.

The Main Principles Of Offshore Banking

So be sure to examine your countries arrangements as well as if they are a signatory for the Typical Reporting Plan (CRS). With an offshore LLC, Limited Firm or Trust can supply a measure of discretion that can not be discovered in any kind of personal domestic account. Financial institutions do have an interest in keeping private the names and also details of their clients as in areas like Panama where personal privacy is militantly kept, nevertheless, Know Your Customer (KYC) rules, the CRS and also the OECD have actually significantly reshaped financial privacy.

Utilizing candidate directors can also be utilized to produce one more layer of protection that eliminates your name from the documentation. This still does not make you totally confidential it can supply layers of security and privacy that would otherwise not be possible. Takeaway, It is never far too late to establish a Fallback.

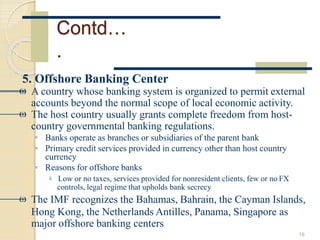

What Is Offshore? The term offshore describes a location outside of one's house country. The term is typically used in the banking as well as economic markets to explain areas where regulations are various from the home nation. Offshore areas are generally island nations, where entities establish up firms, investments, and also deposits.

Offshore Banking - Truths

Boosted pressure is resulting in even more reporting of international accounts to international tax obligation authorities. Comprehending Offshore Offshore can describe a range of foreign-based entities, accounts, or various other financial services. In order to certify as offshore, the task happening should be based in a nation aside from the business or investor's house country.

Special Factors to consider Offshoring is flawlessly lawful since it offers entities with a fantastic bargain of personal privacy and also confidentiality. There is boosted pressure on these countries to report foreign holdings to worldwide tax obligation authorities.

Sorts of Offshoring There are several types of offshoring: Company, spending, as well as banking. We have actually gone right into some detail concerning how these job below. Offshoring Business Offshoring is frequently described as outsourcing when it involves organization activity. This is the act of establishing certain organization functions, such as production or call centers, in a country aside from where the company is headquartered.

Little Known Facts About Offshore Banking.

Firms with substantial sales overseas, such as Apple and Microsoft, might take the possibility to keep associated earnings in overseas accounts in nations with lower tax obligation worries. This practice is mostly utilized by high-net-worth capitalists, as operating offshore accounts can be especially high.

This makes offshore spending beyond the ways of a lot of financiers. Offshore investors might likewise be scrutinized by regulators as well as tax obligation authorities to ensure tax obligations are paid. Offshore Financial Offshore banking involves protecting assets in banks in international nations, which may be limited by the legislations of the consumer's house nationmuch like offshore investing.

Offshore jurisdictions, such as the Bahamas, Bermuda, Cayman Islands, and the Island of Man, are prominent as well as recognized to supply relatively safe investment opportunities. Benefits and also Downsides of Offshore Investing While we have actually noted some typically accepted pros and disadvantages of going offshore, this section considers the advantages as well as disadvantages of overseas investing.

All About Offshore Banking

This suggests you might be on the hook if you do not report your holdings. Make sure you choose a credible broker or investment expert to make sure that your money is handled appropriately.

Home Page find more sites